As filed with the Securities and Exchange Commission on August 23, 2005

UNITED STATES

SECURITIES EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

| Filed by the Registrant x |

||

| Filed by a Party other than the Registrant ¨ |

||

| Check the appropriate box: |

||

| ¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x Definitive Proxy Statement |

||

| ¨ Definitive Additional Materials |

||

| ¨ Soliciting Material Pursuant to Rule 14a-12 |

||

GLOBAL PAYMENTS INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

GLOBAL PAYMENTS INC.

10 GLENLAKE PARKWAY, NORTH TOWER

ATLANTA, GEORGIA 30328

NOTICE OF 2005 ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders:

The 2005 annual meeting of shareholders (the “Annual Meeting”) of Global Payments Inc. (the “Company”) will be held at the Company’s offices at 10 Glenlake Parkway, North Tower, Atlanta, Georgia, 30328-3473 on September 21, 2005, at 11:00 a.m., Atlanta time, for the following purposes:

| 1. | To elect three Class II directors to serve until the annual meeting of shareholders in 2008, or until their successors are duly elected and qualified or until their earlier resignation, retirement, disqualification, removal from office or death, and |

| 2. | To transact any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Only shareholders of record at the close of business on August 5, 2005 are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. You may vote your shares by completing and returning the enclosed proxy card, or you may vote via the Internet or by telephone. Instructions for voting via the Internet or by telephone are set forth in the enclosed proxy statement and proxy card.

YOUR VOTE IS IMPORTANT!

Submitting your proxy does not affect your right to vote in person if you attend the Annual Meeting. Instead, it benefits the Company by reducing the expenses of additional proxy solicitation. Therefore, you are urged to submit your proxy as soon as possible, regardless of whether or not you expect to attend the Annual Meeting. You may revoke your proxy at any time before its exercise by (i) delivering written notice of revocation to the Company’s Corporate Secretary, Suellyn P. Tornay, at the above address, (ii) submitting to the Company a duly executed proxy card bearing a later date, (iii) voting via the Internet or by telephone at a later date, or (iv) appearing at the Annual Meeting and voting in person; provided, however, that no such revocation under clause (i) or (ii) shall be effective until written notice of revocation or a later dated proxy card is received by the Corporate Secretary at or before the Annual Meeting, and no such revocation under clause (iii) shall be effective unless received on or before 11:59 p.m., Atlanta time, on September 20, 2005.

When you submit your proxy, you authorize Paul R. Garcia or Suellyn P. Tornay or either one of them, each with full power of substitution, to vote your shares at the Annual Meeting in accordance with your instructions or, if no instructions are given, for the election of the Class II nominees. The proxies, in their discretion, are further authorized to vote on any adjournments or postponements of the Annual Meeting, for the election of one or more persons to the Board of Directors if any of the nominees becomes unable to serve, on matters which the Board does not know a reasonable time before making the proxy solicitations will be presented at the Annual Meeting, or any other matters which may properly come before the Annual Meeting and any postponements or adjournments thereto.

| By Order of the Board of Directors, |

|

|

| SUELLYN P. TORNAY, Executive Vice President, General Counsel and Corporate Secretary |

Dated: August 23, 2005

August 23, 2005

GLOBAL PAYMENTS INC.

10 GLENLAKE PARKWAY, NORTH TOWER

ATLANTA, GEORGIA 30328

PROXY STATEMENT

Introduction

This Proxy Statement is being furnished to solicit proxies on behalf of the Board of Directors of Global Payments Inc. (the “Company”) for use at the 2005 annual meeting of shareholders (the “Annual Meeting”), and at any adjournments or postponements thereof. The Annual Meeting will be held at the Company’s offices at 10 Glenlake Parkway, North Tower, Atlanta, Georgia, 30328-3473 on September 21, 2005, at 11:00 a.m., Atlanta time, for the following purposes:

| 1. | To elect three Class II directors to serve until the annual meeting of shareholders in 2008, or until their successors are duly elected and qualified or until their earlier resignation, retirement, disqualification, removal from office or death, and |

| 2. | To transact any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof. |

This Proxy Statement and the accompanying proxy card are first being mailed to shareholders on or about August 23, 2005.

Quorum and Voting

Voting Shares. Pursuant to the Company’s Amended and Restated Articles of Incorporation, only the Company’s common shares, no par value (the “Common Stock”), may be voted at the Annual Meeting.

Record Date. Only those holders of Common Stock of record at the close of business on August 5, 2005, are entitled to receive notice and to vote at the Annual Meeting or any adjournment or postponement thereof. On that date, there were 38,417,350 shares of Common Stock issued and outstanding, held by approximately 2,679 shareholders of record. These holders are entitled to one vote per share.

Quorum. In order for any business to be conducted, the holders of a majority of the shares entitled to vote at the Annual Meeting must be present (a “Quorum”), either in person or represented by proxy. For the purpose of determining the presence of a Quorum, abstentions and broker non-votes (which occur when shares held by brokers or nominees for beneficial owners are voted on some matters but not on others) will be counted as present.

Voting Options. Proposal 1, the election of three directors in Class II, will require the vote of the holders of a plurality of the shares of Common Stock represented and entitled to vote at the Annual Meeting at which a Quorum is present. Shareholders may (i) vote “for” each nominee, or (ii) “withhold authority” to vote for any nominee, or (iii) “withhold authority” to vote for all nominees. If a Quorum is present, a vote to “withhold authority” and a broker non-vote will have no effect on the outcome of the election of directors. The three nominees receiving the most votes will be elected to serve as the Class II Directors for a three year term.

Internet and Telephone Voting. Shareholders of record can simplify their voting and reduce the Company’s costs by voting their shares via the Internet or by telephone. Shareholders may submit their proxy voting

1

instructions via the Internet by accessing the website identified on the enclosed proxy card and following instructions on the website. Shareholders who choose to submit their proxy voting instructions by telephone should call the phone number identified on the enclosed proxy card and follow the prompts. The Internet and telephone voting procedures are designed to authenticate shareholders’ identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded. If your shares are held in the name of a bank or broker, the availability of Internet and telephone voting will depend on the voting processes of the applicable bank or broker; therefore, it is recommended that you follow the voting instructions on the form you receive. If you do not choose to vote via the Internet or by telephone, please date, sign, and return the proxy card.

Default Voting. When a proxy is timely executed and not revoked, the shares represented by the proxy will be voted in accordance with the instructions indicated in the proxy. IF NO INSTRUCTIONS ARE INDICATED, HOWEVER, PROXIES WILL BE VOTED “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED IN PROPOSAL 1.

The Board of Directors is not presently aware of any business to be presented for a vote at the Annual Meeting other than the proposals noted above. If any other matter properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is made, in their own discretion.

Revocation of a Proxy. A shareholder’s submission of a proxy via the Internet, by telephone, or by mail does not affect the shareholder’s right to attend in person. A shareholder who has given a proxy may revoke it at any time prior to its being voted at the Annual Meeting by (i) delivering written notice of revocation to the Company’s Corporate Secretary, Suellyn P. Tornay, at the Company’s address on the first page of this proxy statement, (ii) properly submitting to the Company a duly executed proxy card bearing a later date, (iii) voting via the Internet or by telephone at a later date, or (iv) appearing at the Annual Meeting and voting in person; provided, however, that no such revocation under clause (i) or (ii) shall be effective until written notice of revocation or a later dated proxy card is received by the Corporate Secretary at or before the Annual Meeting, and no such revocation under clause (iii) shall be effective unless received on or before 11:59 p.m. Atlanta time on September 20, 2005.

Adjourned Meeting. If a Quorum is not present, the Annual Meeting may be adjourned by the holders of a majority of the shares of Common Stock represented at the Annual Meeting. The Annual Meeting may be rescheduled at the time of the adjournment with no further notice of the reconvened meeting if the date, time and place of the reconvened meeting are announced at the adjourned meeting before its adjournment; provided, however, that if a new record date is or must be fixed, notice of the reconvened meeting must be given to the shareholders of record as of the new record date. An adjournment will have no effect on the business to be conducted at the meeting.

ELECTION OF DIRECTORS; NOMINEES

The Company’s Bylaws provide that the number of directors constituting the Board of Directors shall be not less than two nor more than twelve, as determined from time to time by resolution of the shareholders or of the Board of Directors. The Board of Directors of the Company currently consists of nine members, who are divided into three classes, with the term of office of each class ending in successive years. Each class of directors serves staggered three-year terms or until their respective successors are elected and qualified or until their respective earlier resignation, retirement, disqualification, removal from office or death.

Three directors in Class II, Paul R. Garcia, Gerald J. Wilkins, and Michael W. Trapp, whose terms expire at the Annual Meeting, have been nominated for re-election at the Annual Meeting. The Class II Directors will be elected to hold office until the 2008 annual meeting of shareholders or until their respective successors have been duly elected and qualified or until their respective earlier resignation, retirement, disqualification, removal from office or death. In the event that any of the nominees is unable to serve (which is not anticipated), the persons designated as proxies will cast votes for such other person(s) as they may select.

2

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES FOR DIRECTOR.

The affirmative vote of the holders of a plurality of the shares of Common Stock represented and entitled to vote at the Annual Meeting at which a quorum is present is required for the election of each of the nominees. If a choice is specified on the proxy card by a shareholder, the shares will be voted as specified. If no specification is made, the shares will be voted “FOR” each of the three nominees.

Certain Information Concerning the Nominees and Directors

The following table sets forth the names of the nominees and the directors continuing in office, their ages, the month and year in which they first became directors of the Company, their positions with the Company, their principal occupations and employers for at least the past five years, any other directorships held by them in companies that are subject to the reporting requirements of the Securities Exchange Act of 1934 or any company registered as an investment company under the Investment Company Act of 1940, as well as additional information. There is no family relationship between any of the Company’s executive officers or directors, and there are no arrangements or understandings between any of the Company’s executive officers or directors and any other person pursuant to which any of them was elected an officer or director, other than arrangements or understandings with the directors and officers solely in their capacities as such. For information concerning membership on committees of the Board of Directors, see “Other Information About the Board and its Committees” below.

[Remainder of Page Intentionally Left Blank]

3

NOMINEES FOR DIRECTOR

Class II

Term Expiring Annual Meeting 2008

| Name and Age |

Month and Year First Became a Director |

Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | ||

| Paul R. Garcia (53) |

February 2001 |

President, Chief Executive Officer, and Director of the Company President and Chief Executive Officer of the Company (since February 2001); Chief Executive Officer of NDC eCommerce, a division of National Data Corporation (July 1999 - January 2001); President and Chief Executive Officer of Productivity Point International (March 1997 – September 1998); Group President of First Data Card Services (1995 – 1997); Chief Executive Officer of National Bancard Corporation (NaBANCO) (1989 – 1995); Director, Verso Technologies, Inc. | ||

| Gerald J. Wilkins (47) |

November 2002 |

Director of the Company President, WJG Consulting, Inc. (since 2003); Executive Vice President and Chief Financial Officer of AFC Enterprises, Inc. (2000-2003); Chief Financial Officer of AFC Enterprises, Inc. (1995-2000); Vice President, International Business Planning, KFC International (1993-1995). | ||

| Michael W. Trapp (65) |

July 2003 |

Director of the Company President, Sands Partners, Inc. (since 2000); Managing Partner, Southeast area, Ernst & Young LLP (1993-2000); Director, The Ann Taylor Company. | ||

4

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Class I

Term Expiring Annual Meeting 2007

| Name and Age |

Month and Year First Became a Director |

Positions with the Company, Principal Occupations During Five Years, and Other Directorships | ||

| Edwin H. Burba, Jr. (68) |

February 2001 | Director of the Company National Security Leadership and Business Consultant (since 1993); Commander in Chief, Forces Command, United States Army (1989-1993); Commanding General, Combined Field Army of the Republic of Korea and United States (1988-1989). | ||

| Charles G. Betty (48) |

July 2002 | Director of the Company Chief Executive Officer and Director, Earthlink, Inc. (since 2000); President, Chief Executive Officer, and Director, Earthlink Network, Inc. (1996-2000); Strategic Planning Consultant (1994-1996); President, Chief Executive Officer, and Director, Digital Communications Associates, Inc. (1989-1994); Director, Equifax Inc. | ||

| Raymond L. Killian (68) |

September 2003 | Director of the Company Chairman, Investment Technology Group, Inc. (since 1997); President and Chief Executive Officer, Investment Technology Group, Inc. (1995-2002 and 2004-present); Executive Vice President, Jefferies Group, Inc. (1985-1995); Vice President, Institutional Sales, Goldman Sachs & Co. (1982-1985); Director and majority owner, Voice Automation, Inc.; Partner, High Street Equity Advisors. | ||

5

Class III

Term Expiring Annual Meeting 2006

| Name and Age |

Month and Year First Became a Director |

Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | ||

| Alex W. Hart (65) |

February 2001 | Director of the Company Business Consultant (since October 1997); Chief Executive Officer of Advanta Corporation (1995-1997); Executive Vice Chairman of Advanta Corporation (1994); President and Chief Executive Officer of MasterCard International (1988-1994); Director, Fair Isaac Corporation and Shopping.com Ltd.; Chairman of the Board and Director, Silicon Valley Bancshares. | ||

| William I Jacobs (63) |

February 2001 | Business Advisor (since August 2002); Managing Director and Chief Financial Officer of The New Power Company (2000-2002); Senior Executive Vice President, Strategic Ventures for MasterCard International (1999-2000); Executive Vice President, Global Resources for MasterCard International (1995-1999); Executive Vice President, Chief Operating Officer, Financial Security Assurance, Inc. (1984-1994); Director, Alpharma Inc., Investment Technology Group, Inc., and Asset Acceptance Capital Corp. | ||

| Alan M. Silberstein (57) |

September 2003 | Director of the Company President, Silco Associates Inc. (since October 2004); President and Chief Operating Officer, Debt Resolve, Inc. (2003-2004); President and Chief Executive Officer, Western Union (2000-2001); Chairman and Chief Executive Officer, Claim Services, Travelers Property Casualty Insurance (1996-1997); Executive Vice President, Retail Banking, Midlantic Corporation (1992-1995); Director, Debt Resolve, Inc. and Capital Access Network, Inc.C | ||

6

Other Information About the Board and its Committees

Meetings and Compensation. During the fiscal year ended May 31, 2005, the Company’s Board of Directors held six meetings. All directors attended at least 75% or more of the combined total of the Board of Directors meetings and meetings of the committees on which they served during the period for which the respective director served on the Board of Directors or the applicable committee. For fiscal year 2005, the Company had a policy regarding the compensation of directors which provided that a non-employee director who served as the lead director was compensated at a rate of $60,000 per year in cash and received Common Stock worth $60,000. A non-employee director who served as the chairperson of the audit committee received $40,000 in cash and shares of Common Stock worth $30,000. A non-employee director who served as a chairperson of any other committee received $35,000 in cash and shares of Common Stock worth $30,000. Each other non-employee director received an annual retainer of $30,000 in cash and shares of Common Stock worth $30,000. Such compensation had formerly been paid on June 1 of each year but the decision was made to move the payment date for such compensation to the business day following each annual meeting of shareholders. As a result, the directors received a pro-rated payment from June 1, 2004 until September 21, 2004 (the date of last year’s annual meeting) and then on September 22, 2004 they were entitled to receive a full year’s compensation for the time period between September 22, 2004 until September 21, 2005 (the date of this year’s Annual Meeting). All Common Stock issued pursuant to the director compensation policy was valued at then-prevailing market prices issued under the Company’s Amended and Restated 2000 Long-Term Incentive Plan until the new 2005 Incentive Plan was approved by the shareholders at the 2004 annual meeting.

Pursuant to the foregoing policy, for the time period between June 1, 2004 and September 21, 2004, Mr. Jacobs received $18,600 and 350 shares of stock. Mr. Trapp received $12,400 and 175 shares of stock. General Burba and Mr. Hart each received $10,850 and 175 shares of stock and each of Mr. Betty, Mr. Killian, Mr. Silberstein, and Mr. Wilkins received $9,300 and 175 shares of stock. For the time period from September 22, 2004 until September 21, 2005, Mr. Jacobs received $60,000 and 1064 shares of stock. Mr. Trapp received $40,000 and 532 shares of stock. General Burba and Mr. Hart each received $35,000 and 532 shares of stock and each of Mr. Betty, Mr. Killian, Mr. Silberstein, and Mr. Wilkins received $30,000 and 532 shares of stock.

In addition, all non-employee directors received $1,500 per Board meeting attended except for the lead director who received $2,500 per Board meeting. Non-employee directors who served on a committee received $1,500 per committee meeting, while the chairperson of such committee received $2,500 per committee meeting. Telephonic meetings and telephonic participation are compensated at $1,000 per meeting. The Company does not compensate a director who is also an employee of the Company for his or her services as a director. Directors were also compensated for their out-of-pocket expenses incurred in connection with attendance at Board and committee meetings. One of the Board meetings was held in the Company’s Prague, Czech Republic office. The spouses of the Board members were invited to attend and the Company paid or reimbursed the directors for the applicable out-of-pocket expenses incurred.

Amended and Restated 2000 Non-Employee Director Stock Option Plan. The Company maintains the Amended and Restated 2000 Non-Employee Director Stock Option Plan (the “2000 Director Plan”), which provides for the grant to each of the Company’s non-employee directors of an option to purchase shares of Common Stock having a valuation according to the Black-Scholes option pricing model of $60,000. The purpose of the 2000 Director Plan is to advance the interests of the Company by encouraging ownership of common stock by non-employee directors, thereby giving such directors an increased incentive to devote their efforts to the success of the Company. The options are granted to non-employee directors upon election or appointment to the Board and on the business day following each annual meeting of shareholders. Option grants under the 2000 Director Plan are pro-rated for partial years of service. All options granted under the 2000 Director Plan after October 2003 will become exercisable, in the aggregate, as to 25% of the shares after the first year, 25% after the second year, 25% after the third year, and 25% after the fourth year of service from the date of the grant, except that such options will become fully exercisable upon the death, disability or retirement of the grantee, or upon the grantee’s failure to be re-nominated or re-elected as a director. Upon a grantee’s termination as a director for any reason, the options held by such person under the 2000 Director Plan will remain exercisable for five years or until the earlier

7

expiration of the option. The exercise price for each option granted under the 2000 Director Plan will be the fair market value of the shares of Common Stock subject to the option on the date of the grant. Each option granted under the 2000 Director Plan will, to the extent not previously exercised, terminate and expire on the date which is 10 years after the date of grant of the option unless the 2000 Director Plan provides for earlier termination. During the fiscal year ended May 31, 2005, the eight non-employee directors received a stock option grant for the purchase of 2,469 shares of the Company’s Common Stock at an exercise price of $47.00 per share.

Lead Director. The lead director’s duties generally include serving as the chairperson for all executive sessions of the non-management directors and communicating to the Chief Executive Officer the results of non-management executive Board sessions. Mr. Jacobs serves as the Company’s lead director. Any interested party may contact the lead director by directing such communications to the lead director at the address of the Company (10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473). Any such correspondence received by the Company will be forwarded to the lead director.

Director Independence. In August 2005, the Board of Directors undertook a review of director independence based on the standards for director independence included in the New York Stock Exchange corporate governance rules. During this review, the Board considered relationships and transactions during the past three years between each director or any member of his or her immediate family, on the one hand, and the Company and its subsidiaries and affiliates, on the other hand. The purpose of the review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent. Based on the review, the Board of Directors has determined that all of the directors, except Mr. Garcia (who serves as the Company’s President and Chief Executive Officer), are independent of the Company and its management.

Committees. The Company’s Board of Directors has three separately-designated standing committees; including an Audit Committee, a Compensation Committee, and a Governance and Nominating Committee. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board of Directors has determined that all members of such committees satisfy the independence requirements of the SEC and the New York Stock Exchange. Each of the Company’s committee charters and the Company’s corporate governance guidelines are available on the Company’s website (www.globalpaymentsinc.com), and will be provided free of charge, upon written request of any shareholder addressed to Global Payments Inc., 10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473, Attention: Investor Relations. Certain information regarding the functions of the Board’s committees and their present membership is provided below.

Audit Committee. As of the end of fiscal year 2005, the members of the Audit Committee were Mr. Trapp (Chairperson), Mr. Betty, Mr. Wilkins, and Mr. Silberstein. The Audit Committee operates under a written charter adopted by the Board of Directors which is available on the Company’s website (www.globalpaymentsinc.com). The Audit Committee annually reviews a report by the independent auditors describing the firm’s internal quality control procedures, the scope and plan and the results of the annual audit of the financial statements by the Company’s independent auditors, reviews the scope and plan of the internal audit program, reviews the nature and extent of non-audit professional services performed by the independent auditors and annually recommends to the Board of Directors the firm of independent public accountants to be selected as the Company’s independent auditors for the next fiscal year. During fiscal year 2005, the Audit Committee held five meetings, each of which was separate from regular Board meetings.

Audit Committee Financial Expert. The Board of Directors has determined that the chairman of the Audit Committee, Mr. Trapp, is an audit committee financial expert under the rules established by the SEC and the New York Stock Exchange.

Compensation Committee. As of the end of fiscal year 2005, the members of the Compensation Committee were General Burba (Chairperson), Mr. Hart, Mr. Jacobs, and Mr. Killian. The Committee also operates under a written charter which is available on the Company’s website (www.globalpaymentsinc.com). This committee reviews levels of compensation, benefits, and performance

8

criteria for the Company’s executive officers and administers the Amended and Restated 2000 Long-Term Incentive Plan, the 2000 Employee Stock Purchase Plan, the 2000 Director Plan, and the 2005 Long Term Incentive Plan. During fiscal year 2005, the Compensation Committee held four meetings, all of which were separate from regular Board meetings.

Compensation Committee Interlocks and Insider Participation. None of the members of the Compensation Committee has ever served as an officer or an employee of the Company or any of its subsidiaries.

Governance and Nominating Committee. As of the end of fiscal year 2005, the members of the Governance and Nominating Committee were Mr. Hart (Chairperson), General Burba, Mr. Jacobs, and Mr. Betty. The Committee operates under a formal charter which is available on the Company’s website (www.globalpaymentsinc.com). This committee is responsible for developing and recommending to the Board of Directors a set of corporate governance principles applicable to the Company, determining the structure of the Board and its committees, and for identifying, nominating, proposing, and qualifying nominees for open seats on the Board of Directors, based primarily on the following criteria:

| • | Experience as a member of senior management or director of a significant business corporation, educational institution, or not-for-profit organization; |

| • | Particular skills or experience that enhances the overall composition of the Board of Directors; |

| • | Serves on no more than five other publicly-held corporation boards of directors; and |

| • | Serves on no more than three other audit committees of boards of directors of publicly-held corporations. |

The Governance and Nominating Committee does not consider or accept nominees to the Board of Directors nominated by shareholders. The Governance and Nominating Committee may use outside consultants to assist in identifying candidates. Members of the Governance and Nominating Committee must discuss and evaluate possible candidates prior to recommending them to the Board. This committee had two formal meetings during fiscal year 2005, each of which was separate from a regular Board meeting.

Communications from Security Holders. Any security holder may contact any member of the Board of Directors by directing such communication to such board member at the address of the Company (10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473). Any such correspondence received by the Company shall be forwarded to the applicable Board member.

Attendance at Annual Meeting. All directors are expected to attend the Company’s annual meeting of shareholders. On the date of the fiscal year 2004 annual shareholder meeting, there were nine members on the Company’s Board of Directors and eight members were present at the meeting.

Certain Legal Proceedings. William I Jacobs, a member of the Board of Directors, was the Chief Financial Officer and Managing Director of The New Power Company, a subsidiary of NewPower Holdings, Inc. Both The New Power Company and NewPower Holdings, Inc. filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Northern District of Georgia on June 11, 2002.

[Remainder of Page Intentionally Left Blank]

9

Common Stock Ownership of Management

The following table sets forth information as of August 1, 2005, with respect to the beneficial ownership of Common Stock by the nominees to the Board, by the directors of the Company, by each of the persons named in the Summary Compensation Table, and by the 13 persons, as a group, who were directors and/or executive officers of the Company on August 1, 2005.

Except as explained in the footnotes below, the named persons have sole voting and investment power with regard to the shares shown as beneficially owned by them.

| Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class (1) |

|||||

| Paul R. Garcia |

393,694 | (2) | 1.01 | % | |||

| Charles G. Betty |

4,758 | (3) | * | ||||

| Edwin H. Burba, Jr. |

11,411 | (4) | * | ||||

| Alex W. Hart |

12,137 | (4) | * | ||||

| William I Jacobs |

20,027 | (5) | * | ||||

| Raymond L. Killian, Jr. |

2,473 | (6) | * | ||||

| Alan M. Silberstein |

2,473 | (6) | * | ||||

| Michael W. Trapp |

2,745 | (7) | * | ||||

| Gerald J. Wilkins |

3,834 | (8) | * | ||||

| James G. Kelly |

216,836 | (9) | * | ||||

| Carl J. Williams |

32,000 | (10) | * | ||||

| Raul C. Limon |

235,018 | (11) | * | ||||

| Jeffery C. McWey |

125,308 | (12) | * | ||||

| All Directors and Executive Officers as a group |

994,130 | (13) | 2.54 | % | |||

| * | Less than one percent. |

| (1) | The percentage calculations are based on 39,118,440 shares of Common Stock outstanding on August 1, 2005. |

| (2) | This amount includes 45,531 shares of restricted stock over which Mr. Garcia currently has sole voting power and includes options to purchase 251,229 shares which are currently exercisable or will become exercisable within 60 days. |

| (3) | This amount includes options to purchase 2,919 shares which are currently exercisable or will become exercisable within 60 days. |

| (4) | This amount includes options to purchase 8,596 shares which are currently exercisable or will become exercisable within 60 days. |

| (5) | This amount includes options to purchase 8,596 shares which are currently exercisable or will become exercisable within 60 days. This amount also includes 10,823 shares held by a grantor retained annuity trust of which Mr. Jacobs is the trustee and has the sole right to receive annuity payments. |

| (6) | This amount includes options to purchase 1,426 shares which are currently exercisable or will become exercisable within 60 days. |

| (7) | This amount includes options to purchase 1,579 shares which are currently exercisable or will become exercisable within 60 days. |

| (8) | This amount includes options to purchase 2,311 shares which are currently exercisable or will become exercisable within 60 days. |

| (9) | This amount includes 29,868 shares of restricted stock over which Mr. Kelly currently has sole voting power and options to purchase 147,595 shares which are currently exercisable or will become exercisable within 60 days. |

| (10) | This amount includes 10,000 shares of restricted stock over which Mr. Williams currently has sole voting power and options to purchase 20,000 shares which are currently exercisable or will become exercisable within 60 days. |

10

| (11) | This amount includes options to purchase 11,729 shares which are currently exercisable or will become exercisable within 60 days. This amount includes 223,289 shares held by Anglia Holdings, LLC of which Mr. Limon is the sole member. |

| (12) | This amount includes options to purchase 107,510 shares which are currently exercisable. Mr. McWey’s employment with the Company was terminated on June 3, 2005 and, as a result, the vesting for certain options were accelerated pursuant to a separation agreement entered into by the parties. |

| (13) | This amount includes 506,871 options which are currently exercisable or will become exercisable within 60 days. |

[Remainder of Page Intentionally Left Blank]

11

Common Stock Ownership by Certain Other Persons

The following table sets forth information as of the date indicated with respect to the only persons who are known by the Company to be the beneficial owners of more than 5% of the outstanding shares of Common Stock.

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class on 5/31/05 | ||

| Canadian Imperial Bank of Commerce (1) Commerce Court Toronto, Ontario, Canada M5L 1A2 |

6,000,000 | 15.3% | ||

| T. Rowe Price Associates, Inc. (2) 100 East Pratt Street Baltimore, Maryland 21202 |

3,805,860 | 9.7% | ||

| Earnest Partners, LLC (3) 75 Fourteenth Street Suite 2300 Atlanta, Georgia 30309 |

2,154,298 | 5.5% | ||

| Columbia Wagner Asset Management, L.P. ( 4) WAM Acquisition GP, Inc. 227 West Monroe Street, Suite 3000 Chicago, Illinois 60606 |

1,942,080 | 5.0% | ||

| (1) | This information is contained in a Schedule 13D/A filed by Canadian Imperial Bank of Commerce with the Securities and Exchange Commission on May 14, 2004. Canadian Imperial Bank of Commerce reports sole dispositive and sole voting power over all 6,000,000 shares. |

| (2) | This information is contained in a Schedule 13G filed by T. Rowe Price Associates, Inc. with the Securities and Exchange Commission on February 11, 2005. T. Rowe Price Associates, Inc. reports sole dispositive power of all 3,805,860 shares and sole voting power for 608,300 shares. |

| (3) | This information is contained in a Schedule 13G filed by Earnest Partners, LLC with the Securities and Exchange Commission on February 14, 2005. Earnest Partners, LLC reports sole dispositive power of all 2,154,298 shares, sole voting power for 1,267,600 shares and shared voting power for 473,798 shares. |

| (4) | This information is contained in a Schedule 13G/A filed by Columbia Wanger Asset Management, L.P. and WAM Acquisition GP, Inc. with the Securities and Exchange Commission on February 14, 2005. Columbia Wanger Asset Management, L.P. and WAM Acquisition GP, Inc. each report that they have shared voting and shared dispositive power over all 1,942,080 shares. |

12

REPORT OF THE COMPENSATION COMMITTEE

Decisions on compensation and equity-based plans are made by the Compensation Committee. All decisions by the Compensation Committee relating to the compensation of the Company’s executive officers are made by the Compensation Committee. Decisions of the Compensation Committee related to equity-based plans are made solely by that committee in order for awards or grants under the Company’s equity-based plans to satisfy Rule 16b-3 pursuant to the Securities Exchange Act of 1934, as amended.

The Company’s primary objective in designing and implementing its compensation programs is to maximize shareholder value over time through alignment of employee performance with business goals and strategies that serve shareholders’ interests. The overall goal of the Compensation Committee is to develop executive compensation and equity-based programs which are consistent with and linked to the Company’s strategic and annual business objectives.

Compensation Philosophy

The Compensation Committee has adopted certain principles which are applied in structuring the compensation opportunity for executive officers. These are:

Long-Term and At-Risk Focus. A significant percentage of total compensation for executive officers should be composed of long-term, at-risk rewards to focus senior management on the long-term interests of shareholders. Equity-based plans should comprise a major part of the long-term, at-risk portion of total compensation to encourage shareholder value-based management decisions and to link compensation to Company performance and shareholder interests.

Short-Term and At-Risk Focus. A significant portion of cash compensation for executives is linked to achievement of annual business plans or performance objectives. This includes cash bonuses that may be approved by the Compensation Committee relating to those objectives. Our executive officers face real risk of not receiving bonuses under this plan, which also recognizes variability in individual and overall Company performance.

Competitiveness. Base pay and total compensation should be competitive with other similar companies based upon size, products and markets. A proxy survey of peer group companies is conducted periodically.

Stock Option Awards, Restricted Stock Grants, and Bonus Deferral Program

Equity-based compensation comprises a significant portion of the Company’s key employee compensation programs. The Company’s Amended and Restated 2000 Long-Term Incentive Plan which was replaced by the Company’s 2005 Incentive Plan, has been utilized for this component of executive officer, long-term, equity-oriented compensation. Such plan is administered solely by the Compensation Committee and can involve stock options and restricted stock grants:

Stock Options. Options provide key employees with the opportunity to achieve an equity interest in the Company. Stock options are granted at 100% of fair market value on the date of grant and have 10-year terms. Stock options granted during the 2005 fiscal year vest one year after the date of grant with respect to 25% of the shares granted, an additional 25% after two years, an additional 25% after three years, and the remaining 25% after four years. The objective is to emphasize a long-term focus by key employees in the acquisition and holding of Common Stock. The number of stock options granted to an individual is based upon the individual’s potential to contribute to future growth of the Company. The frequency and size of individual grant amounts vary.

Restricted Stock. Restricted stock grants are designed to be granted on a selective basis to key employees to further focus them on the longer-term performance of the Company. Generally, grants of restricted shares are subject to forfeiture if a grantee, among other conditions, leaves the Company prior to expiration of the restricted period. Generally, the restrictions lapse two years after

13

the date of grant with respect to 33% of the shares granted, an additional 33% after three years, and the remaining 33% after four years. There are occasional exceptions to the vesting schedule.

Bonus Deferral Program. A bonus deferral program, approved by the Board of Directors, allows certain executives to defer a portion of their cash bonus in the form of a restricted stock grant. This program is consistent with the Company’s objectives to increase executives’ share ownership and at-risk compensation. Since participating executives are deferring earned cash in the form of shares at risk of forfeiture over three years, the amount deferred is increased by 35%. None of the named executive officers participated in the plan for fiscal year 2005.

Chief Executive Officer’s Compensation

Mr. Garcia’s fiscal year 2005 compensation derived primarily from annual performance plans, as well as commitments under his Employment Agreement effective July 12, 2000 (see “Employment Agreements with Paul R. Garcia, James G. Kelly and Carl J. Williams” below).

Mr. Garcia’s potential bonus award is reviewed annually and is based upon achievement of certain quantitative and qualitative performance objectives. Mr. Garcia agreed to have his bonus at risk under this plan to preserve deductibility by the Company under Code Section 162(m). The performance objectives in the plan for the 2005 fiscal year included objectives for earnings per share growth and revenue growth. The balance of his 2005 fiscal year bonus was determined by other objectives.

The Compensation Committee’s general approach in setting Mr. Garcia’s annual compensation opportunity is to seek to be competitive with other companies in the Company’s industry, and for his compensation plan to be consistent with the Company’s business, strategy, and operating results. The Compensation Committee also seeks to have a large percentage of Mr. Garcia’s compensation opportunity based upon current year performance as well as actions to provide sustained long-term growth in shareholder value. To accomplish this, a mix of cash, restricted stock and stock options are provided to Mr. Garcia, which provides a significant element of risk based upon the Company’s performance.

COMPENSATION COMMITTEE

Edwin H. Burba, Jr., Chairperson

Alex W. Hart

William I Jacobs

Raymond L. Killian, Jr.

14

COMPENSATION AND OTHER BENEFITS

The following table presents certain summary information concerning compensation paid or accrued by the Company for services rendered in all capacities during the fiscal years ended May 31, 2005 (“2005 fiscal year”), May 31, 2004 (“2004 fiscal year”), and May 31, 2003 (“2003 fiscal year”), for (i) the Chief Executive Officer of the Company; and (ii) each of the four other most highly compensated executive officers of the Company (determined as of the end of the last fiscal year) whose total annual salary and bonus exceeded $100,000. Each person listed in (i) and (ii) above are hereinafter referred to as the “Named Executive Officers.”

SUMMARY COMPENSATION TABLE

| Annual Compensation |

Long Term Compensation Awards |

||||||||||||||||||

| Name and Principal Position |

Fiscal Year |

Salary |

Bonus |

Restricted Stock Awards(1) |

Securities Underlying Options(#) |

All Other Compensation |

|||||||||||||

| Paul R. Garcia |

2005 | $ | 600,000 | $ | 600,000 | — | 77,000 | $ | 30,042 | (2) | |||||||||

| Chairman, President and |

2004 | $ | 500,000 | $ | 460,000 | $ | 1,499,981 | 70,000 | $ | 26,199 | (3) | ||||||||

| Chief Executive Officer |

2003 | $ | 450,000 | $ | 300,000 | $ | 81,000 | 100,000 | $ | 9,038 | (4) | ||||||||

| James G. Kelly |

2005 | $ | 375,000 | $ | 301,480 | — | 38,000 | $ | 12,397 | (2) | |||||||||

| Sr. Executive Vice President |

2004 | $ | 350,000 | $ | 230,000 | $ | 999,998 | 30,612 | $ | 3,231 | (3) | ||||||||

| and Chief Financial Officer |

2003 | $ | 325,000 | $ | 170,000 | $ | 20,250 | 50,000 | — | ||||||||||

| Carl J. Williams |

2005 | $ | 315,000 | $ | 250,000 | — | 15,000 | $ | 154,545 | (2) | |||||||||

| President—World-Wide |

2004 | $ | 57,692 | (5) | $ | 20,000 | (5) | — | 65,000 | $ | 0 | ||||||||

| Payment Processing |

2003 | — | — | — | — | — | |||||||||||||

| Raul C. Limon |

2005 | $ | 300,000 | $ | 232,564 | — | 12,375 | ||||||||||||

| Chief Executive Officer- |

2004 | $ | 119,017 | (6) | $ | 84,996 | (6) | — | 35,540 | $ | 18,679 | (7) | |||||||

| DolEx |

2003 | ||||||||||||||||||

| Jeffery C. McWey |

2005 | $ | 310,000 | $ | 187,000 | — | 25,000 | $ | 9,802 | (2) | |||||||||

| Executive Vice President |

2004 | $ | 300,000 | $ | 135,000 | $ | 499,982 | 30,612 | $ | 26,143 | (3) | ||||||||

| and Chief Marketing Officer |

2003 | $ | 275,000 | $ | 157,500 | $ | 364,700 | 30,000 | $ | 11,038 | (4) | ||||||||

| (1) | Awards of restricted shares to Messrs. Garcia, Kelly and McWey have been made under the Company’s Amended and Restated 2000 Long-Term Incentive Plan. The restricted stock awards are valued in the table based upon the closing market prices of the Company’s Common Stock on the grant dates. Grantees have the right to vote and dividends are payable to the grantees with respect to all awards of restricted shares reported in this column. The value of the restricted stock awards held by the Named Executive Officers on May 31, 2005, based on the closing price of $69.30 per share, was $3,155,298; $2,069,852; 0; 0; and $1,717,808 for Messrs. Garcia, Kelly, Williams, Limon, and McWey, respectively. The numbers of shares of restricted stock held by Messrs. Garcia, Kelly, |

15

Williams, Limon, and McWey on May 31, 2005, were 45,531; 29,868; 0; 0; and 24,788, respectively.

| (2) | Such amount includes (i) Company contributions to the 401(k) plan on behalf of Mr. Garcia ($8,400), Mr. Kelly ($10,798), and Mr. McWey ($7,892); (ii) attendance at the Company’s President’s Club trip on behalf of Mr. Garcia ($1,842), Mr. Kelly ($1,599), Mr. Williams ($501), and Mr. McWey ($1,910); (iii) the Company’s payment of financial planning expenses for Mr. Garcia ($18,000); (iv) the Company’s payment of $1,800 a year in connection with Mr. Garcia’s membership at the Buckhead Club; (v) the Company’s payment of $46,152 in moving expenses in connection with Mr. William’s temporary assignment to Prague, Czech Republic; (vi) the Company’s payment of $7,544 for shipping costs associated with Mr. William’s temporary assignment to Prague; (vii) the Company’s payment of $3,500 for school enrollment fees for Mr. William’s son in connection with a possible relocation, (viii) the Company’s payment of $985 in connection with tax return preparation for Mr. Williams, (ix) the Company’s payment of $29,812 in airfare and other expense reimbursements incurred in connection with the visa requirements for Mr. Williams, his wife, and his son and in connection with transportation for Mr. Williams and his family to and from Prague from their permanent residence in the United States, and (x) $66,051 in rent and utilities paid by the Company for its apartment in Prague which was occupied by Mr. Williams and his family throughout fiscal year 2005. The U.S. dollar amount shown is based upon the conversion rates from Euros to dollars in effect on 8/16/05. |

| (3) | Such amount includes (i) Company contributions to the 401(k) plan on behalf of Mr. Garcia ($7,136), Mr. Kelly ($3,231), and Mr. McWey ($6,784) and (ii) attendance at the Company’s President’s Club trip on behalf of Mr. Garcia ($19,063) and Mr. McWey ($19,359). |

| (4) | Such amount includes (i) Company contributions to the 401(k) plan on behalf of Mr. Garcia ($8,295) and Mr. McWey ($8,743) and (ii) attendance at the Company’s President’s Club trip on behalf of Mr. Garcia ($743) and Mr. McWey ($2,295). |

| (5) | Mr. Williams began full time employment on March 15, 2004 and the compensation and bonus shown are for a partial year. |

| (6) | Mr. Limon began full time employment with the Company on November 12, 2003 and the compensation and bonus shown are for a partial year. |

| (7) | Such amount represents amounts paid for rent allowance and tuition allowance as required by Mr. Limon’s employment agreement in effect at the time. |

[Remainder of Page Intentionally Left Blank]

16

Option Grants in Last Fiscal Year

The following table sets forth information concerning option grants during the 2005 fiscal year to the Named Executive Officers.

OPTION GRANTS IN LAST FISCAL YEAR

| Name |

Number of Securities Underlying Options Granted (#) |

% of Total Options Granted to Employees in Fiscal Year (1) |

Exercise or Base |

Expiration Date |

Grant Date Present Value (2) | ||||||||

| Paul R. Garcia |

77,000 | 9.31 | % | $ | 46.70 | 06/01/2014 | $ | 1,891,120 | |||||

| James G. Kelly |

38,000 | 4.59 | % | $ | 46.70 | 06/01/2014 | $ | 933,280 | |||||

| Carl J. Williams |

15,000 | 1.81 | % | $ | 46.70 | 06/01/2014 | $ | 368,400 | |||||

| Raul C. Limon |

12,375 | 1.50 | % | $ | 45.00 | 06/25/2014 | $ | 292,050 | |||||

| Jeffery C. McWey |

25,000 | 3.02 | % | $ | 46.70 | 06/01/2014 | $ | 614,000 | |||||

| (1) | The Company granted options to employees to purchase a total of 827,363 shares during the 2005 fiscal year. Stock options are granted at 100% of fair market value on the date of the grant and have 10 year terms. Stock options granted during the 2005 fiscal year vest one year after the date of the grant with respect to 25% of the shares granted, an additional 25% after two years, an additional 25% after three years, and the remaining 25% after four years. |

| (2) | These grant date values are based on the Black-Scholes option pricing model utilizing the following assumptions: expected volatility (40%), risk-free interest rates / rate of return (3.75%), dividend yield (0.60%), and expected lives / time of exercise (7 years). The values are for illustrative purposes only, and are not intended to be a forecast of what future performance will be. |

17

Option Exercises and Fiscal Year-End Values

The following table sets forth information concerning options exercised by the Named Executive Officers during the 2005 fiscal year and the number and value of unexercised options held by the Named Executive Officers as of May 31, 2005.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| Name |

Exercised Options |

Number of Securities Underlying Unexercised at Fiscal Year-End (#) |

Value of Unexercised In-the-Money Options at Fiscal Year-End | ||||||||||||

| Shares Acquired on Exercise (#) |

Value Realized |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable | ||||||||||

| Paul R. Garcia |

30,000 | $ | 1,400,150 | 174,479 | 338,204 | $ | 8,249,658 | $ | 12,635,762 | ||||||

| James G. Kelly |

30,000 | $ | 1,307,364 | 105,946 | 127,350 | $ | 5,292,334 | $ | 4,128,226 | ||||||

| Carl J. Williams |

0 | 0 | 16,250 | 63,750 | $ | 423,962 | $ | 1,610,887 | |||||||

| Raul C. Limon |

0 | 0 | 8,635 | 38,280 | $ | 223,387 | $ | 970,875 | |||||||

| Jeffery C. McWey |

14,000 | $ | 368,340 | 22,064 | 99,349 | $ | 798,128 | $ | 3,240,875 | ||||||

18

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Employment Agreements with Paul R. Garcia, James G. Kelly, and Carl J. Williams. Each of Messrs. Garcia, Kelly, and Williams are parties to employment agreements with the Company, the material terms of which are summarized below.

Each of the foregoing executives is entitled to a minimum annual salary, subject to yearly review, plus an annual at-risk incentive bonus opportunity, which is determined annually based on a range of specific financial objectives reflecting his area and scope of responsibility. Each such executive is also entitled to participate in all incentive, savings and welfare benefit plans generally made available to executive officers of the Company. The current annual salaries of these Named Executive Officers are as follows: Mr. Garcia—$750,000; Mr. Kelly—$460,000; and Mr. Williams—$400,000. On his date of termination, Mr. McWey’s salary was $310,000.

Each of the foregoing executives has agreed in his employment agreement not to disclose confidential information or compete with the employer, and not to solicit the employer’s customers or recruit its employees, for a period of 24 months following the termination of his employment.

Each of the employment agreements may be terminated by the Company at any time for “cause” or “poor performance” (as defined therein) or for no reason, or by the applicable executive with or without “good reason” (as defined therein). Each employment agreement will also be terminated upon the death, disability or retirement of the executive. Depending on the reason for the termination and when it occurs, the executive will be entitled to certain severance benefits, as described below.

If, prior to a change in control, the executive’s employment is terminated by the Company without cause (but not for poor performance) or he resigns for good reason, the Company will be required to pay him his accrued salary and benefits through the date of termination plus a portion of his target annual bonus for the current year. For up to 18 months, or until he is employed elsewhere or he violates certain restrictive covenants, the Company will continue to pay the executive his base salary and will provide him with health insurance coverage. In addition, all of the executive’s restricted stock awards will vest and those stock options that would have vested in the next 24 months will vest and remain exercisable for 90 days after the end of the salary continuation period, as described above.

If, prior to a change in control, the executive’s employment is terminated by the Company for poor performance, the Company will be required to pay him his accrued salary and benefits through the date of termination plus a portion of his target annual bonus for the current year. For up to 12 months, or until he is employed elsewhere or he violates certain restrictive covenants, the Company will continue to pay the executive his base salary and will provide him with health insurance coverage. In addition, all of the executive’s restricted stock awards and stock options that would have vested in the next 24 months will vest and the options will remain exercisable for 90 days after the earlier of six months or the end of the salary continuation period, as described above.

If, within 36 months after a change in control, the executive’s employment is terminated by the Company without cause or he resigns for good reason, the Company will be required to pay him his accrued salary and benefits through the date of termination plus 100% of his annual bonus opportunity for the current year. For 24 months (unless he violates certain restrictive covenants), the Company will continue to pay the executive his base salary and will provide him with health insurance coverage. In addition, all of the executive’s restricted stock awards and stock options will vest and the options will remain exercisable for 90 days after the end of the salary continuation period, as described above.

19

Whether or not a change in control shall have occurred, if the employment of the executive is terminated by reason of his death, disability or retirement, he will be entitled to his accrued salary and benefits through the date of termination and any death, disability or retirement benefits that may apply, but no additional severance amount. If the Company terminates the executive for cause, or if he resigns from the Company without good reason, he will be entitled to his accrued salary and benefits through the date of termination, but no additional severance amount.

For purposes of these employment agreements, a change in control of the Company is generally defined as the acquisition by a third party of 35% or more of the voting power of the Company, or the consummation of certain mergers, asset sales or other major business combinations. A restructuring or separation of any line of business of the Company will not, of itself, constitute a change in control. Each of these employment agreements provides that the executive will be entitled to a tax gross-up payment from the Company to cover any excise tax liability he may incur as a result of payments or benefits contingent on a change in control, but such gross-up payment will be made only if the after-tax benefit to the executive of such tax gross-up is at least $50,000. If not, the benefits would be reduced to an amount that would not trigger the excise tax.

Employment Agreement with Raul C. Limon. Mr. Limon is a party to an employment agreement with DolEx Envios, S.A. de C.V., (“DolEx”) the material terms of which are summarized below. DolEx is an indirect wholly owned subsidiary of the Company.

Mr. Limon is entitled to a minimum annual salary, subject to yearly review, plus an annual at-risk incentive bonus opportunity, which is determined annually based on a range of specific financial objectives reflecting his area and scope of responsibility. Mr. Limon is also entitled to receive the employee benefits generally made available to similarly situated employees of DolEx. Mr. Limon’s current annual salary is $317,500.

Mr. Limon has agreed in his employment agreement not to disclose confidential information or compete with the employer, and not to solicit the employer’s customers or recruit its employees, for a period of 24 months following the termination of his employment.

Mr. Limon’s employment agreement may be terminated by DolEx at any time for “cause” (as defined therein), without cause, or by Mr. Limon upon resignation. His employment agreement will also be terminated in the event of Mr. Limon’s death or upon his physical or mental incapacity. Depending on the reason for the termination and when it occurs, Mr. Limon may be entitled to certain severance benefits, as required under Mexico’s Federal Labor Law. In addition, in the event DolEx elects to terminate Mr. Limon’s agreement without cause, any stock options that would have vested in the next 24 months will vest and remain exercisable for 90 days after the date of Mr. Limon’s termination.

Separation Agreement with Mr. McWey. Mr. McWey’s employment with the Company and his employment agreement were terminated on June 3, 2005. Pursuant to the terms of the separation agreement, Mr. McWey will receive severance and health benefits for up to 18 months. Such severance and benefits shall terminate in the event Mr. McWey (i) becomes employed or earns an income from becoming an owner, partner or an independent contractor of any other entity, (ii) earns an income from becoming a consultant, starting a business, or otherwise (except for income earned in connection with serving on a board of directors under certain limited circumstances), or (iii) violates certain restrictive covenants.

All of Mr. McWey’s restricted stock awards became vested and those options that would have vested in the 24 month period following the date of termination vested and will remain exercisable for 90 days after the end of the salary continuation period, as described above. Mr. McWey has agreed not to disclose confidential information, not to compete with the Company, and not to solicit the Company’s customers or recruit its employees for a period of 24 months following the termination of his employment.

20

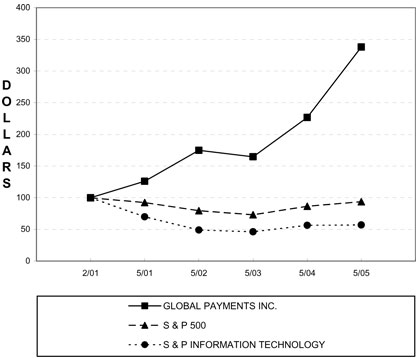

SHAREHOLDER RETURN ANALYSIS

The following line-graph presentation compares cumulative shareholder returns of the Company with the Standard & Poor’s Information Technology Index and the Standard & Poor’s 500 Stock Index for the fifty-two month period beginning on February 1, 2001, the date of the spin-off transaction from the Company’s former parent, National Data Corporation (now known as NDC Health Corporation). The line graph assumes the investment of $100 in the Company’s Common Stock, the Standard & Poor’s Information Technology Index, and the Standard & Poor’s 500 Stock Index on February 1, 2001, and assumes reinvestment of all dividends.

* $100 invested on 2/1/01 in stock or on 1/3/01 in index-including reinvestments of divdends. Fiscal year ending May 31.

Copyright © 2002, Standard & Poor’s, a division of the McGraw-Hill Companies, inc. All rights reserved.

www.researchdatagroup.com/S&P.htm

21

AUDITOR INFORMATION

Independent Public Accountants

Deloitte & Touche LLP (“Deloitte”) served as the Company’s independent auditor for the fiscal year ending May 31, 2005, and is serving as the independent auditor for the Company for the current fiscal year which began on June 1, 2005. A representative of Deloitte is expected to be present at the 2005 Annual Meeting. The representative will be given the opportunity to make a statement, if he or she desires to do so, and will be available to respond to appropriate questions from shareholders.

Audit Fees

The aggregate fees billed by Deloitte for professional services rendered for the audit of the Company’s annual financial statements, the reviews of the financial statements included in the Company’s quarterly reports on Form 10-Q, and services that are normally provided by the independent public accountant in connection with statutory and regulatory filings or engagements were $460,752 for fiscal year 2004 and were $711,879 for fiscal year 2005.

Audit Related Fees

The aggregate fees billed by Deloitte for professional services rendered for assurance and related services that are related to the performance of the audit or review of the Company’s financial statements were $131,602 for fiscal year 2004, and were $26,000 for fiscal year 2005. Audit-related services in fiscal year 2004 included fees for Sarbanes-Oxley Section 404 readiness, consents to registration statements on Form S-3, and agreed-upon procedure audits for the Company’s Canadian debit network certification. In fiscal year 2005, such fees were for benefit plan audits.

Tax Fees

The aggregate fees billed by Deloitte for professional services rendered for tax compliance, tax advice, and tax planning were $430,610 for fiscal year 2004 and were $423,463 for fiscal year 2005. The fees primarily related to services provided in connection with the Company’s acquisitions and related tax structuring. In fiscal year 2005, $147,000 of such fees were for tax return preparation and compliance and $276,463 were for tax consulting and advisory services.

All Other Fees

The aggregate fees billed by Deloitte & Touche LLP for professional services rendered for services, other than stated above under the captions Audit Fees, Audit Related Fees, and Tax Fees, were $13,268 for fiscal year 2004 and $0 for fiscal year 2005. The fees incurred in fiscal year 2004 were primarily related to professional development courses that the Company’s finance and accounting personnel attended.

Audit Committee Pre-Approval Policies

The Audit Committee must approve any audit services and any permissible non-audit services provided by Deloitte prior to the commencement of the services. In making its pre-approval determination, the Audit Committee considers whether providing the non-audit services is compatible with maintaining the auditor’s independence. To minimize relationships which could appear to impair the objectivity of the independent auditor, it is the Audit Committee’s practice to restrict the non-audit services that may be provided to the Company by the Company’s independent auditor to tax services and merger and acquisition due diligence and integration services.

The Audit Committee has delegated to the Chair of the Audit Committee the authority to approve non-audit services by the independent auditor within the guidelines set forth above provided that the fees associated with the applicable engagement are not anticipated to exceed $100,000. Any decision by the Chair to pre-

22

approve non-audit services must be presented to the full Audit Committee for ratification at its next scheduled meeting. All of the services described under the captions Audit Fees, Audit Related Fees, Tax Fees, and All Other Fees were approved by the Audit Committee in accordance with the foregoing policy.

Audit Committee Review

The Company’s Audit Committee has reviewed the services rendered and the fees billed by Deloitte for the fiscal year ended May 31, 2005. The Audit Committee has determined that the services rendered and the fees billed last year that were not related directly to the audit of the Company’s financial statements were compatible with the maintenance of independence of Deloitte as the Company’s independent accountants.

23

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Canadian Imperial Bank of Commerce (“CIBC”)

On March 20, 2001, the Company purchased CIBC’s merchant acquiring business. As a result of this transaction, CIBC acquired beneficial ownership of approximately 26.25% of the Company’s outstanding Common Stock, and two of its employees were appointed to the Company’s Board of Directors. Both of the CIBC directors resigned from the Company’s Board on October 24, 2003. As of May 31, 2005, CIBC still held approximately 15.3% of the Company’s Common Stock.

Transition Services Agreement. CIBC provided transitional services under an agreement to provide various support services to the merchant acquiring business for a 24-month period commencing on the acquisition date of March 20, 2001. The purpose of the agreement was to facilitate the integration of the business into the Company’s existing operations. These services included customer service, credit and debit card processing and settlement functions. Although the CIBC back-end conversion was completed in November 2001, CIBC has continued to provide certain transitional services subsequent to the 24-month period based on an informal arrangement. In fiscal 2005, the Company incurred expenses of approximately $204,000 (Canadian dollars) related to these services.

Credit Facility. The Company has a credit facility from CIBC, as administrative agent, that provides a line of credit up to $175 million (Canadian dollars) with an additional overdraft facility available to cover larger advances during periods of peak usage of credit and debit cards. The Canadian credit facility consists of two components: (i) a revolving line of credit of up to $100 million Canadian dollars, or approximately $80 million U.S. dollars based on exchange rates existing on May 31, 2005, which is provided by a syndicate of U.S. banks and which the Company refers to as the Tranche A Loans and (ii) a revolving line of credit of up to $75 million Canadian dollars, or approximately $60 million U.S. dollars based on exchange rates existing on May 31, 2005, which is provided by CIBC and which the Company refers to as the Tranche B Loans. The Canadian credit facility also contains an additional overdraft facility available to cover larger advances during periods of peak card usage. The Tranche A Loans bear interest at a variable rate based on the U.S. dollar Prime Rate, Canadian dollar LIBOR or the U.S. dollar LIBOR, and the Tranche B Loans bear interest at a variable rate based on the CIBC Offered Rate (an overnight rate in Canadian dollars), Canadian dollar LIBOR, or the Canadian dollar Prime Rate. This line of credit is secured by a first priority security interest in the Company’s accounts receivable from VISA Canada/International for transactions processed through the CIBC VISA bank identification number, the bank accounts in which the settlement funds are deposited, and by guarantees from certain of the Company’s subsidiaries. The Canadian credit facility also contains certain financial and non-financial covenants and events of default customary for financings of this nature. The Canadian credit facility is scheduled to expire on November 18, 2005, and can be renewed for up to two consecutive 364-day periods at the option of all parties. The amount borrowed under the CIBC credit facility is restricted in use to pay merchants and is generally received from VISA Canada/International on the following day.

Marketing Alliance Agreement. Under a Marketing Alliance Agreement between CIBC and the Company, CIBC refers all new merchant processing relationships exclusively to the Company in exchange for a referral fee. CIBC also continues to provide the banking services required by the Company as part of the merchant processing business and provides the Company with access to Visa clearing capabilities in Canada. The agreement has an initial term of ten years from March 20, 2001. During fiscal year 2005, the Company paid CIBC approximately $220,000 (Canadian dollars) in connection with such agreement.

24

ADDITIONAL INFORMATION

Solicitation of Proxies

The cost of soliciting proxies will be borne by the Company; however, shareholders voting electronically (via phone or the Internet) should understand that there may be costs associated with electronic access, such as usage charges from Internet service providers or telephone companies. In addition to solicitation of shareholders of record by mail, telephone, or personal contact, arrangements will be made with brokerage houses to furnish proxy materials to their principals, and the Company may reimburse them for mailing expenses. Custodians and fiduciaries will be supplied with proxy materials to forward to beneficial owners of Common Stock. The Company has also engaged Georgeson Shareholder to solicit proxies on behalf of the Company, and the Company estimates that the fees for such services will not exceed $20,000.

Shareholder Proposals

Only proper proposals under Rule 14a-8 of the Securities Exchange Act of 1934 (the “Exchange Act”) which are timely received will be included in the Proxy Statement and Proxy for the 2006 annual meeting of shareholders. Notice of shareholder proposals will be considered untimely if received by the Company after April 25, 2006. If the Company does not receive notice of any matter that a shareholder wishes to raise at the 2006 annual meeting by July 9, 2006, and a matter is properly raised at such meeting, the proxies granted in connection with that meeting will have discretionary authority whether or not to vote on the matter.

Shareholder List

The Company will maintain a list of shareholders entitled to vote at the Annual Meeting at its corporate offices at 10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473. The list will be available for examination at the Annual Meeting.

Annual Report on Form 10-K

A copy of the Company’s Annual Report on Form 10-K, including the financial statements and financial statement schedules (but without exhibits) for the fiscal year ended May 31, 2005, will be provided, free of charge, upon written request of any shareholder addressed to Global Payments Inc., 10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473, Attention: Investor Relations. Additionally, the EDGAR version of the Company’s Form 10-K is available on the Internet on the SEC’s web site (www.sec.gov).

Closing Price

The closing price of the Common Stock, as reported by the New York Stock Exchange on August 17, 2005 was $66.75.

Code of Business Conduct and Ethics

The Company has adopted a code of ethics for senior financial officers which is available on the Company’s website at www.globalpaymentsinc.com. The Company intends to post amendments to or waivers from such code of ethics (to the extent applicable to the Company’s principal executive officer, principal financial officer or principal accounting officer) on its website at www.globalpaymentsinc.com.

25

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based solely on a review of the copies of reporting forms furnished to the Company, or written representations that no annual forms (Form 5) were required, the Company believes that, during the 2005 fiscal year, all of its officers, directors and 10% shareholders complied with the reporting requirements of the SEC regarding their ownership and changes in ownership of Common Stock (as required pursuant to Section 16(a) of the Securities Exchange Act of 1934), except Mr. Williams had a late Form 4 reflecting the receipt of one stock option grant.

REPORT OF THE AUDIT COMMITTEE

The primary responsibility of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board and to report the results of the Audit Committee’s activities to the Board. Management has the primary responsibility for the financial statements and reporting process, including the systems of internal control, and Deloitte & Touche LLP (the independent auditor) is responsible for auditing those financial statements in accordance with generally accepted accounting principles and issuing a report thereon. In this context, the Audit Committee has reviewed and discussed with management and the independent auditor the Company’s audited financial statements as of and for the year ended May 31, 2005. The Audit Committee has discussed with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61, Codification of Statements on Auditing Standards, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. The Audit Committee has received and reviewed the written disclosures and the letter from the independent auditor required by Independence Standard No. 1, Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors their independence. In addition, the Audit Committee has considered the compatibility of nonaudit services with the auditor’s independence. Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements, referred to above, be included in the Company’s Annual Report on Form 10-K for the year ended May 31, 2005 for filing with the SEC.

AUDIT COMMITTEE

Michael W. Trapp, Chairperson

Charles G. Betty

Gerald J. Wilkins

Alan M. Silberstein

[Remainder of Page Intentionally Left Blank]

26

| PROXY | GLOBAL PAYMENTS INC. | |

| CARD | ATLANTA, GEORGIA | |

| 2005 ANNUAL MEETING OF SHAREHOLDERS |